There is a reason that long-term residents with financial acumen are raising alarm about the conduct of the Lake Bluff School Board. This will attempt to explain that concern.

#1 The School Board gets whatever tax money it asks for. They simply tell the county (the board makes a “levy”) how much to collect and the county collects taxes for the Lake Bluff schools in proportion to the market value of real estate owned within the district. If real estate market values drop by ten percent for everyone in the district, the county just increases the tax rate by ten percent so that the amount of the school levy is produced.

#2 The new elementary school is beautiful. Everyone agrees. If you spend $26 million, you get a nice school. The controversy that began with the Eric Grenier Board and continues with the MJ Brady Board was never about the school – it was and is about the financing of the school.

#3 There is nothing wrong with public financing. Indeed, it is a moral responsibility. If the people who happened to be living in the district in 2007, 2008 and 2009 paid the whole $26 million, and the people who used the school after that paid nothing, then tax collections would not be properly matched to the beneficiaries of the school. By borrowing the construction money and then paying it off over decades, the tax collections come from the beneficiaries over those decades.

Corallary to #3: It is wrong for tax districts to “save” or to accumulate a “rainy day fund” or a slush fund. Such behavior violates the imperative of matching. The current activities of the district should be paid by the current residents of the district, not past residents or future residents.

The bonds that were sold (and additional expenses) to generate the $26 million were authorized in a very close referendum. The Eric Grenier Board had a lot of difficulty in garnering and reconciling many conflicting ideas, in translating those ideas into a construction budget, and in getting the construction started before a second referendum would be required. In the end, they didn’t even get it done for the start of its first school year.

MJ writes: “…the community voted to replace a 100-year old asbestos ridden, moldy, leaking elementary school with a state of the art facility. This investment was long overdue.”

http://gazebonews.com/2013/04/02/open-letter-from-lake-bluff-district-65-school-board-candidate-mj-brady/

While I recognize that there was strong sentiment to abandon East School even as there was reluctance to tear it down, I still don’t know why we also tore down Central School. But the referendum passed by 20 votes and that might have been the end of it except for the impossible promises of the Eric Grenier Board made prior to the referendum.

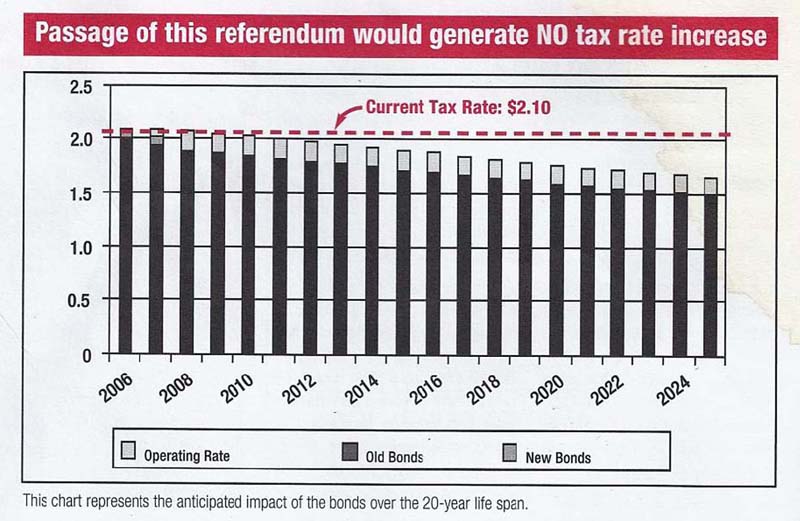

We were told that the real estate tax rate would not rise above $2.10 because the Eric Grenier Board knew how to get a $26 million school for free – at least that was the popular understanding. In fact, the new bonds would replace old bonds that were about to be paid-off.

Further, unlike home mortgage where the principle and interest combine to a stable payment over the life of the payoff, District 65 makes relatively low payments of about $1.2 million for 2010 through 2015. Then there is a big jump for 2016 to about $2 million followed by steady increases in the annual payments to a maximum $3.3 million.

The early years with low payments help keep the related tax levy low for those early years by placing an extra-heavy burden on the later years. In the April 17, 2007 referendum, we voted on the question: “Shall the Board of Education of Lake Bluff School District 65, Lake County, build and equip a new elementary school building and issue bonds to $24,400,000 for the purpose of paying the costs thereof?”

http://www.isbe.state.il.us/research/pdfs/referenda_2007.pdf

The question was answered in the affirmative by a scant 20 votes. The promise was clear: That voting “yes” would not raise the tax rate. By suppressing the payments through 2015 (by burdening later years) the Eric Grenier Board improved the chance that the School Board could keep that promise long enough that most people would forget that it was made.

Shifting the repayment burden from the early years to the later years is perfectly lawful. There can be good reason for doing it. But the only real purpose of the Grenier Shift was to hoodwink the referendum voters.

Specifically, prior to 2008, the annual tax levy of District 65 included money to make payments on the old bonds. The Eric Grenier Board understood that the annual levy would be a million dollars less when the payments were no longer required. If the Board could have new payments start when the old payments ended, the levy would be constant and the Eric Grenier Board could say that the new school “would not cause you tax bill to rise.”

The Eric Grenier Board was remarkably stubborn in its refusal to acknowledge that our tax bills would fall if the bonds were not passed. I thought that was dishonest. The claim that a vote for the bonds would not cause taxes to rise was a disingenuous claim.

So we built the school. The tax rate did not go up. The Eric Grenier Board was replaced by the MJ Brady Board. The tax rate still did not go up. The School Board collected tax money far in excess of their needs and had $10 million sitting idle in the bank.

And then a group of concerned taxpayers started to raise questions.

This is where the PR side of the story becomes the tail that wags the dog. The Eric Grenier Board and the MJ Brady Board had a narrative that was seamless on the surface. Just as a “no” vote on the referendum was characterized as “anti-children” so now was any question of the board’s financial management. Only a deeper understanding would reveal the sad truth.

Five years before the school was built, district voters had authorized a special increase in the tax rate that didn’t have anything to do with bonds. Earlier school boards had mismanaged district finances. The increase should have been temporary since it was intended to address a temporary problem.

It is the nature of politicians, however, and especially amateur politicians, to raise taxes more readily than to reduce them. More money coming in makes budgeting, rationing and scheduling easier. It gives them more power and more options. And it takes less discipline.

Besides, many people can rally around the idea of raising taxes to benefit the schools. Fewer people can get enthusiastic about lowering the school tax to benefit the taxpayers.

So the tax rate was already excessive as evidenced by the millions of unspent money piling-up in the school district bank account. In spite of these unbudgeted millions, the MJ Brady Board kept the levy at a level that resulted in a tax rate near the $2.10 trumpeted by the Eric Grenier Board. Presumably, the amateur politicians of the MJ Brady Board felt entitled to it.

But then about three years ago, real estate values declined throughout the dollar-denominated economy and the $2.10 promise that was always untenable became less so. Lower assessed values result in higher rates regardless of the levy. The school board could have used its massive cash store to resist the rise in the school tax rate, especially since reduced real estate values imposes real hardships on many residents.

The School Board did not reduce its levy and the cash continued to pile up. And then, in a move that astounded many of us for its callous grasping wrongheadedness, the School Board borrowed more money.

So, in 2010 the status was this: (1) seven years earlier, the residents had authorized a special hike in the school tax rate that should have been temporary but kept pulling in more money that the board could spend, (2) three years earlier the residents authorized a new school bond which involved tearing down a school many strongly wanted to save (East) and tearing down another school that everyone agreed was still perfectly serviceable (Central), and (3) the repayment schedule shifted the tax burden of the bonds a decade out into the future.

That was the context three years ago when the MJ Brady Board decided to borrow money to make the bond interest payments by further mortgaging the new school. Even though we were still in the early years of the bond schedule when the annual payments were nearly interest-only, the School Board sold refunding bonds. The MJ Brady Board agreed that we would make additional $118 thousand payments for the life of the school bonds in exchange for skipping the already low, interest-only $1.2 million annual payment for a couple years.

So there was no tax relief from spending down reserves, and there was no tax relief from this new borrowing. Idle cash piled up at a faster rate as residents struggled with more disciplined budgets. But so what? After all, the board membership had significant turnover, the school was built and the construction mismanagement had been forgotten. The special tax rate increase from an even earlier time had long been forgotten.

Two years ago the rate shot up to $2.31 and last year to $2.51.

Shifting the repayment burden of the original bonds from the early years to the later years is perfectly lawful. There can be good reason for doing it. But the only real purpose of the Grenier Shift was to hoodwink the referendum voters.

It is incomprehensible to me what the motive could have been for the Brady Board to further shift the repayment burden from current residents to future residents by selling the refunding bonds. The Brady Shift was not necessitated by a financial squeeze – we had millions on hand and a high operating tax rate. It was not necessitated by concern for the tax rate – in spite of the $2.10 promise of the Grenier Board, the Brady Board allowed falling assessed values to drive up the school tax rate.

It give me the impression that the Brady Board confused the public sector with the private sector. If MJ were operating a private enterprise where revenues are earned from customers, then high revenues and accumulating cash balances might be some measure of success. But the district is a public sector actor. It gets whatever levy it requests. Extracting millions of excess dollars from current taxpayers and millions more from future taxpayers is not an accomplishment to be proud of. It does not measure success nor financial skill. Indeed, it is a measure of lazy planning and sloppy budgeting.

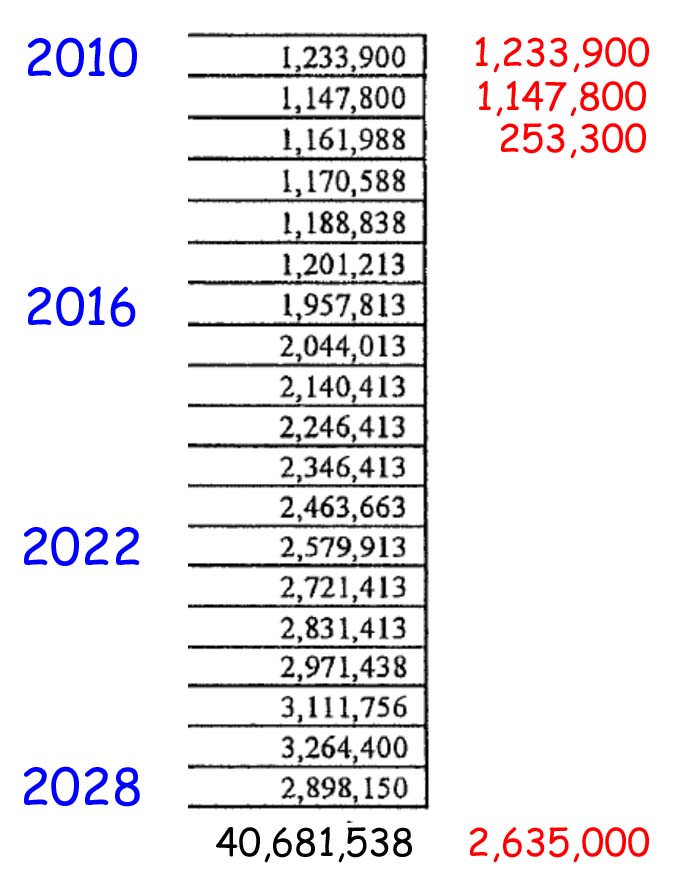

In the following table, the center column is taken for a document distributed at a recent board meeting but dated 2/23/2010. It shows the annual payments of principle and interest for the original bonds that the Grenier Board sold in 2008 plus the interest on the refunding bonds that the Brady Board sold in 2010. (The principle of the refunding bonds is repaid in a single lump sum the year after the payments on the original bonds ends.) The red numbers in the third column show how the proceeds from the refunding bonds were used to make payments on the original bonds for the first few years.

As you can see from the middle column above, District 65 makes relatively low payments of about $1.2 million for 2010 through 2015. Then there is a big jump for 2016 to about $2 million followed by steady increases in the annual payments to a maximum $3.3 million. The amount of the shifted burden over the 19 years can be measured this way: The sum of the payments for the first six years is $7,104,327. The sum of the payments for the last six years is $17,798,570. Payments at the end are more than twice that of the beginning -- 250 percent more, in fact.

So the taxpayers who live in District 65 now get a new school and future taxpayers get an older school. Further, taxpayers who live here through 2015 also get a reduced tax burden because those who will live in District 65 from 2016 through 2028 bear an extra burden from both the Grenier Shift and the Brady Shift. And fourthly, postponing principle repayment means that more interest is paid overall. The table in the graphic above shows 19 years of payments totaling $40,681,538. That total would have been about $5 million lower if not for the Grenier Shift and the Brady Shift.

IF the $40.7 million were not inflated by the Grenier Shift and the Brady Shift and equal payment were made, they would be $1,878,000 because: $1,878,000 * 19 = $35,682,000

Yet Ms. Brady says quite incredibly: “Like all such, it was structured to meet the needs of the individual school district. Many would argue that the more “traditional” bond structure is ours: higher payments later in the issue in an effort to have level tax rates, not level payments, thus providing stable and predictable property tax bills for homeowners.”

http://gazebonews.com/2013/04/02/open-letter-from-lake-bluff-district-65-school-board-candidate-mj-brady/

The only two members of the Brady Board seeking to continue as board members are MJ Brady and Eric Waggoner. The Caucus slate from two years ago, Susan Rider-Porter, Mark Barry, Leigh Ann Charlot, joined the board after the Brady Shift was enacted. Ms. Brady and Mr. Waggoner voted for the Brady Shift.

Ms. Brady brags, “As my critics note I’ve twice been before the caucus and twice been recommended. I expect I would have been recommended this time, too.”

http://gazebonews.com/2013/04/02/open-letter-from-lake-bluff-district-65-school-board-candidate-mj-brady/

I’m not so sure about that. In fact, I wonder if she dodged the Caucus interviews so that she didn’t have to answer questions about her confused financial management.

Two years ago, Kate Amaral ran against the Caucus slate and lost. Ms. Amaral is running again, and this time as last time she is running against the Caucus slate. So Ms. Brady and Mr. Wagggoner have not interviewed with the Caucus since the Brady Shift and Ms. Amaral has never interviewed at all. None of them have been asked about the compounded burden that has shifted from current taxpayers to future taxpayers.

Taxpayers who plan to stay in Lake Bluff for ten or twenty years are exploited by taxpayers who will move away sooner. We have not had an opportunity to put that matter directly to the Brady, Waggoner or Amaral who have banded together as the SmartChoices trio. Assuming they understand what they are doing, it seems that their compassion for the current students is made at the expense of future students.

Amaral letter to GN: “If they were involved with our schools, came to the board meetings or concerned themselves with anything other than financial presentations, they would know this work is already in process…Our superintendent has a vision for our schools to be internationally known, and an inexperienced single-focus board out of touch with our schools will only slow down the realization of that vision.”

http://gazebonews.com/2013/04/03/an-open-letter-from-lake-bluff-district-65-candidate-kate-amaral/

Waggoner Open Statement: At 1:23 of the debate, Eric Waggoner says in his prepared opening statement: “Elections are about values … Should education be viewed primarily through the lens of taxation or as the firm bedrock of a community?”

http://gazebonews.com/2013/03/31/lake-bluff-caucus-member-questions-email-from-school-board-president/

Brady email: “Maybe the naysayers are surprised as they‘ve had so little contact with school governance. Or maybe they are feigning shock to create a campaign issue. Either way the school board candidates they endorse have no business serving in matters they so little understand. Indeed the naysayers and their slate of school board candidates will take us back in time.”

http://65.pxxq.com/MJBemail.html

Brady in GN: “Structuring the schedule of bond repayment differently would not have saved $5,000,000. The county extends taxes to meet the annual principal and interest payments on debt. If the bonds had been structured differently, the extensions would be whatever they need to be to meet those payments. There would not be “$5 million for educational services.” And in any event it is not legally permissible to shift tax receipts collected for debt service to an operating fund. Let me be perfectly clear on this point: Structuring the schedule of bond repayment differently would not have saved $5,000,000 for educational purposes. Our community deserves better than such intellectual dishonesty.”

http://gazebonews.com/2013/04/02/open-letter-from-lake-bluff-district-65-school-board-candidate-mj-brady/

“Intellectual dishonesty” she says. The Grenier Shift and the Brady Shift required that District 65 taxpayers pay $5 million more in taxes over the 19 years of payments. (Notice that she does not deny that.) So by taxing $5 million less for debt service, she could have taxed $5 million more for “educational purposes” with no overall change in the school tax. Or the school tax could be $5 million less over those 19 years.

No one is talking about moving “tax receipts collected for debt service to an operating fund”. Ms. Brady’s straw man is the only intellectual dishonesty. That is, assuming she understand what she is doing.

We don’t need passion, we need managers. And we damn sure don’t need liars. And maybe the Eric Grenier Board and the MJ Brady Board weren’t. Maybe they were simply hyper-selfish, and had an utter disregard for the people in District 65 years in the future. Maybe they only care about what they want right now. Maybe they are simply acting like small children who say, “gimme, gimme, gimme” because the future is just simply unimportant to them. They remind me of the British sitcom by that same name:

But there is no third way: Either they knew they were selling out the future and they just didn’t care, or they didn’t know because they are simply inadequate for the job. Either way they have failed.

Some of us have a full grasp of the damage that the Eric Grenier Board and the MJ Brady Board have done. Accusing us of selfishness gets it exactly backward. It is they whose selfishness is breathtaking. So which is it, SmartChoices? Do you shamelessly dissemble or do you simply not understand?