Donald E.

Russ

November

4, 2012

Dear

School Board,

I am a

long-time resident of District 65.

I have had two children go through these schools and I currently have a grandson

attending. But I do not claim any

special status because of those things.

I write to you simply as a long-time taxpayer to the District.

Not to

belabor that point, but on July 4th, 1776 we adopted a Declaration

that listed many hurts and concluded, “In every stage of these Oppressions We

have Petitioned for Redress in the most humble terms: Our repeated Petitions

have been answered only by repeated injury. A Prince, whose character is thus

marked by every act which may define a Tyrant, is unfit to be the ruler of a

free people.”

Accordingly, we enshrined our most fundamental rights in the First Amendment of

our Constitution which concludes “and to petition the Government for a redress

of grievances.”

Further, I

realize that three of you were elected to the Board only last year.

And while a majority of you have been involved in the conduct of the

Board for years longer, I am not, on the whole, speaking to you individually.

You are the Board. The

Board’s conduct in recent years and its conduct going forward is the subject of

this letter. It is my right “to

petition the Government for a redress of grievances.”

You don’t

have to read it or, even if you do, you don’t have to react to it but “A Prince,

whose character is thus marked by every act which may define a Tyrant, is unfit

to be the ruler of a free people.”

2001 student enrollment: 1,137

“Unfunded

mandates” is a term that was invented to describe what the 50 states and the

federal government do to school districts.

Also, to restrain self-destructive school districts from placing

impossible burdens on their captive taxpayers, statutory limits are placed on

year-to-year tax increases and voter approval is required for greater rate

changes and for borrowing.

And so it

was that on April Fool’s Day, 2003, the taxpayers of District 65 voted to waive

the tax cap and give the District a 15 percent raise.

That was

an expression of trust. The

taxpayers voted to have their own taxes raised, trusting that the School Board

would use that money to solve the problems of the past and plan properly for the

future. Parents of students would

not have produced an adequate number of votes.

Many people who live in District 65 but who do not use its services voted

in favor of giving the District more taxing authority simply as a matter of

faith.

2004 student enrollment: 1,092

Prohibition was never a good idea.

It remains the only Constitutional Amendment that was subsequently repealed, but

not before it gave birth to organized crime.

We never would have had Prohibition were it not linked to women’s

suffrage. Were the issues divorced,

women would still have gotten the right to vote but Constitution would certainly

not have been amended for Prohibition.

Central

School was a great school, structurally speaking.

Built for the Baby Boomers, it was architecturally uninspired but it was

sturdy and sound. By contrast, East

School, built 60 years earlier, was half-subterranean and presented

water-related issues. (Fixing East

School was an option. It was

advocated by many who thought that the building was architecturally significant.

The School Board simply preferred to build rather than fix.)

So we would build.

The School

Board was clear: East was the

problem. That narrative was

inconsistent with the concurrent discussion of using East for another community

purpose, but still it was relentlessly argued that we had to build because East was unfit.

There was not space to move the K-1-2 students of East into Central with

the 3-4-5 students. So, we would

have to expand Central School.

But we

didn’t. Instead of demolishing East

and expanding Central, we demolished both and built LBES.

Like Prohibition, the demolition of Central was never a stand-alone

issue. Most people agreed that

beautiful East had to go, but the School Board never explained to us why Central

had to go too.

It was

bait-and-switch. The mildew in East

required consolidation at Central.

Doubling the population at Central required some construction.

And as long as we are knocking down schools anyway, and building at the

Central site, we might as well knock down Central too and build bigger.

And anyone who inquired about the logic of all that was told, “Just look

at the great school we could have!”

2005 student enrollment: 1,083

I remember

sitting in Central gym for the School Board’s referendum presentation when Neil

Dahlmann was handing-out an anti-referendum document.

He was told that he could do so outside the building, but not inside.

It seemed unnecessarily heavy-handed to me. This was before I met Mr.

Dahlmann [1] and

I wasn’t the only one who saw that as petty.

During that meeting, I marveled at the resilient floor of the gym and

commented on the concrete and brick walls, and I asked what was wrong with

Central. The answer I got in that

forum was that the heating is difficult to control in one room. I was at a loss

for words but a gentleman across the audience helped by wondering if that couldn’t

be “addressed technically”.

I left the

meeting convinced that there was nothing wrong with Central except that there

was no love for it. The sentiment

was that if we were going to lose East, then we should scrap Central as well and

start with a clean canvas. A series

of architectural renderings reinforced that idea.

Adding-on to Central would have been far less costly than demolishing it

and building LBES in its place, but the School Board never entertained that

alternative. Instead, they just

kept producing more renderings and repeating, “This is what we should have.”

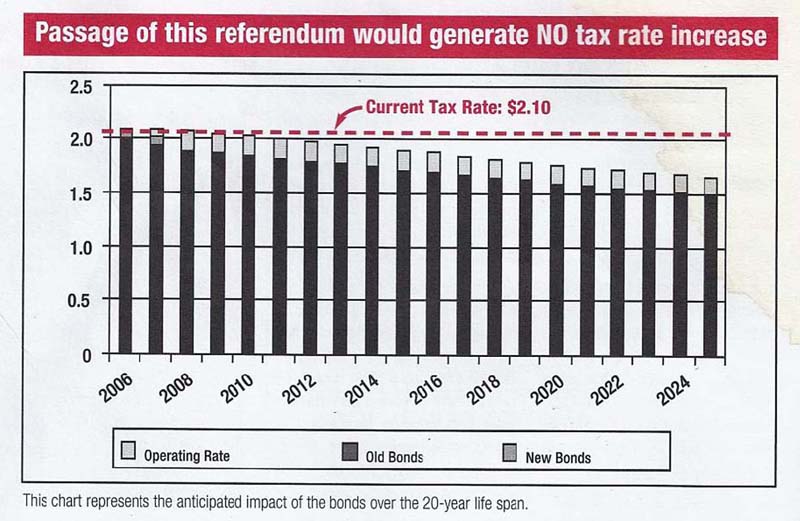

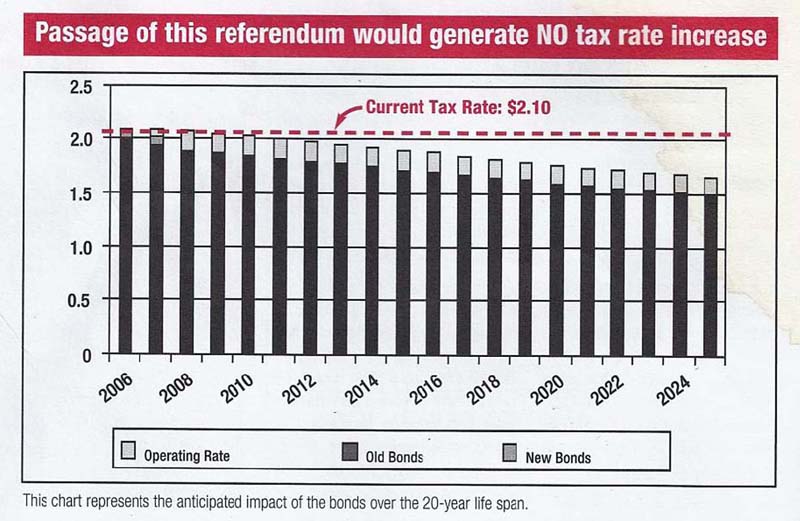

The School

Board never compared the cost of LBES to the cost of an expanded Central; the

Board only compared the interest of new bonds for LBES to the interest of the old bonds

expiring. “We are going to get a

beautiful school and there will be no increase in taxes!”

And the taxpayers who put their trust in the School Board by granting it

greater taxing authority just a few years earlier were convinced the Board members

were wizards: Why try to salvage

dumb old Central when we are getting a school for free?

“Just look are the renderings!”

Only the

Board and the architects knew that the renderings were a lie.

The rest of us were dismissed as being obsessed with costs and future taxes.

We were told that any sad, old people who care about their pocketbooks

more than our children should just look at this chart:

The chart

is confusing but the message shouts:

There is nothing to worry about!

Besides, just look at these renderings.

There are big ball fields around the school!

Unfortunately the ball fields would be replaced with a giant, fenced-off water

detention pond. But that would not

be revealed until after the referendum.

There was some mention of Phase 2 and the certainty of more construction

spending even beyond the referendum amounts, but through more wizardry the Phase

2 costs would not affect taxes

2007 student enrollment: 1,017

And so

began the current era of the School Board, the MJ Brady Era.

A majority of the current School Board members have been involved with

the Board throughout this period.

Our new school has super-insulated walls and so it seems does our new Board.

Faced with a long-term trend of declining enrollment and an 82,000 square

foot school in the pipeline, they added 6700 square feet to Middle School.

Unlike

excess taxes that pile-up in bank accounts, funds collected from the sale of

bonds must be spent promptly. The

Board had collected $24.4 million and a stack of artistic renderings, but no

real plans in spite of the millions of anticipatory dollars spent before the

referendum. And then a pointless

reluctance to coordinate with the Village Board and the Park Board delayed the

letting of contracts so long that a repeat referendum nearly became necessary.

But of all

the errors,

the most

glaring failure

was the construction schedule: “The

big question is the timing. It's been a little over a year since the ground

breaking and the project is a few weeks behind schedule. The final opening date

is a moving target. According to Ms. Lair, parents said it was more important to

start school on time rather than wait for the new building to be completed.

School will start on Sept. 8, as planned, but students will be housed off-site

for an as-yet-undetermined period of time. The plan calls for grades K-3 to go

to East School and grades 4-5 and multi-age to hold classes at Christ Church on

Waukegan and Hwy 60 in Lake Forest.”

2009 student enrollment: 952

At the

Open House, I asked about the late opening.

“Oh, nobody cares about that.

Just look at this great building, now that we’re here!”

Not the response I was hoping to get from a Board member, but not a

surprise either.

LBES will

stand just as it is for at least a hundred years.

By scraping both East and Central in favor of the super-insulated LBES we

expected operating efficiencies and tight, predictable budgets.

Instead the School Board has been taxing far beyond budget requirements

causing millions of dollars to rest in bank accounts.

At last this has drawn the attention of a few District 65 residents who

have the experience and wisdom to provide meaningful oversight.

There are

many “stakeholders” of District 65:

students, parents, teachers, administrators, vendors, the School Board and the

taxpayers. The first five groups

have only a temporary interest in the activities of District 65.

The students and parents take services from the District; the teachers,

administrators and vendors take money from the District.

It is only

the taxpayers and their representatives on the School Board who fund the District who have a long-term interest in its success.

It is only the people who have invested great personal wealth in property

within District 65 who have a continuing interest in the value reflected onto

that property by good schools. It

is only the real estate taxpayers who have committed to pay, whatever the price

will be.

I suspect

that some school boards are captured by parents.

Yes, they are taxpayers too, but parents as a lobby have a more focused

interest that may engender a greater, if temporary, passion.

And their priorities are not synchronous with the long-term interest of

the institution. It would likewise

be suboptimal if a school board were captured by teachers or other vendor.

Just think

what a school board would do if it consisted only of students!

It is the taxpayers alone who have an interest in the satisfaction of all

stakeholders. And it is the

taxpayers alone who can strike a proper balance between the competing interests

of the other stakeholders. Only the

taxpayers’ interests should be represented on the School Board.

2010 student enrollment: 933

In recent

years, the housing market has deflated.

Nearly four years of 8 percent unemployment levels have combined to cause

many foreclosures and distressed sales.

Some District 65 residents are “underwater” because the value of their

home is less than the value of the mortgage they are paying.

All District residents have had their ability to refinance or borrow

limited by their reduce equity.

So what

did the School Board do? Increase

the tax levy by a half-million to nearly $15 million, the highest it had ever

been. This higher collection for a

shrinking assessed base combined to make the tax rate skyrocket from $2.08 per

$100 of assessed value to $2.31 per.

If the

School Board would have reduced the levy by a million dollars, the rate would

not have changed from the $2.08 level where it had remained for eight years.

Budgeted spending would have been unaffected because the School Board had

many millions sitting idle in bank accounts.

Those many

millions had been collected from the real estate taxes of the District

residents. Collected for no

specific purpose, that slush fund imposed a hardship on the residents.

It could have been used to relieve some of that hardship.

It wasn’t.[4]

Whose interest

does the MJ Brady Board serve?

The next

year it got worse. The slush

fund continued to grow even as the tax rate skyrocketed.

Rates 2002 through 2009 were 2.08, 2.07, 2.10, 2.10, 2.06, 2.04, 2.07,

2.08 and then jumped last[5] year to 2.31 and now this year to 2.51!

2011 student enrollment: 906

The LBMS

Choir Room can get over-heated so the MJ Brady School Board is discussing a $2

million fix.

Déjà vu?

Sounds like the approach an earlier

School Board took toward Central School.

Why crack the window when $2 million does so much more?

And who will miss the $2 million when you have many times that in the

bank? Especially since a single

excess levy can replace it?

Exasperated, last summer District 65 resident Al Boese commented in the above

link, “I was rather astonished to learn recently of a plan by Lake Bluff School

District 65 to spend $2.0 MM for a new choral practice room and redesign the

Middle School entrance. Does some genetic transformation overcome anyone who

comes in contact with Education? Seemingly normal thinking people whom

heretofore would recognize excess, somehow, when associated with a school

district, become possessed by the Education genetic flaw that drives that person

to become devoted to spending money wisely or foolishly, but spend they do. We

see this on a national, state and local basis.”

What other

explanation could there be? We

don’t need to wait six months for the strategic plan to recognize this for what

it is: Indulgence.

This is the kind of thinking that results from the mere existence of

a

multi-million dollar slush fund.

If tax levies strictly conformed to tight budgets with no slush fund

providing a cushion, then the rigor of the process would give us all assurance

that spending was properly considered.

Budgeting

nickels and dimes is

revealed

to be a sham

when the School Board is

floating on a sea of off-budget millions.

In such an environment, when the question is raised, “Why don’t we apply

the East School façade to the Middle School entrance?” there is no basis for

objection. Anyone who asks, “How

does this further the interest of the interest of the taxpayers in supporting

educational purposes?” is dismissed as irrelevant to the discussion.

The only question entertained in such an environment is, “Wouldn’t it be

nice?”

To their

credit, the School Board has engaged Bill Melsheimer of ECRA consultants to

chart out a more rational approach.

He facilitated “focus groups” at the LBES recently.

Parents were invited to the second of the three one-hour sessions.

One parent commented about

the “Town

Hall” meeting

that was addressed by several of the Concerned Citizens and by concerned parent

Megan Miles. His comment was,

“Everyone spoke about lowering taxes.

No one spoke about spending more.”

The

perception was that the Concerned Citizens have a selfish agenda and that the

School Board does not. This is the

reverse is truth. But perception

trumps truth in a public debate that has already become polarized.

Again. And that is the fault

of the School Board for abandoning a more rigorous process where tax levies

strictly conform to tight budgets with no slush fund.

During the

visioning part of the parents’ session, several people made clear and balanced

comments like those of Nisha Burns.

But there were also reactionary comments.

One man said, “Lake Bluff schools should be the best in northern

Illinois” and he was followed by another man who said “I think they should be

the best in the country”.

Clearly

our curriculum should be synchronized with 67 so that our students can succeed

at 115. And perhaps we should have

a hot lunch program. Those are

decisions that should flow from that rigorous process that is trusted by all

stakeholders and this should not be a tug-of-war between parents and other

taxpayers. Any other perception is

the fault of the School Board.

Anonymous

hate mail

has started and that is the fault of the MJ Brady School Board too.

2012 student enrollment: 869

There is a

solution. There is a simple action

that the School Board can take that will immediately settle the rapidly

increasing polarization within the District.

There is a way that the School Board members can re-establish trust with those

they represent and return the process to orderly deliberation.

Immediately pay ten million dollars from the slush fund to the

Debt Service Fund.

By

committing this amount to debt service, one third of the excess taxes still

remain liquid and available for contingencies and an orderly transition a

rigorous and more rational decision process.

Because the County Clerk would not have to collect for debt service, the

tax rate would immediately fall some twenty cents.

And because this sum represents several years of debt service, that rate

reduction would persist.

The money

paid into the Debt Service Fund cannot be removed from it.

This is therefore one of the very few ways that the MJ Brady Board can

commit future School Boards. The

Board will continue to tax each year for budgeted spending and so this action

has no effect on the spending that results from the regular budgeting process.

It simply designates the excess taxes of recent past years to be returned

to the taxpayers in the near future years.

The LBES

bonds are first callable in 2018 so this will take us there.

You then on the School Board would be in an ideal position to refinance

and rationalize our debt structure before the programed repayments triple.

The accusation that you now on the School Board are hoarding cash to make

indulgent spending feasible would be refuted.

You would show good faith.

In all

three of the sessions that same focusing evening, the 2009 Fiscal Austerity Plan

was raised. Concerned Citizens,

parents, community – each of the

three groups independently recalled that document.

Jill Rosa had asked about it during the Town Hall meeting.

I followed-up with Liz Zoellick who sent me an email on 10/24 explaining

where I could find it on the lb65.org website at that time.

I note that the lb65.org website has been overhauled and that the 2009

Fiscal Austerity Plan has been deleted from it.

The

now-deleted document that was dated May 19, 2010 said, “The major intent is to

maintain a 25 percent operating fund balance at the end of five years.”

At every school meeting I have attended where President Brady was

present, she has said that there are “guidelines” for minimum fund balances but

“there is no statutory maximum”.

It is also

true that there is a 25 percent guideline for maximum fund balances but there is

no statutory minimum.

2016* student enrollment: 814

This

month, you will set the levy.

People who live in the 5.6 square miles of the District will be required to pay

you whatever sum you demand. People

can lose their houses for failing to “render unto Caesar”.

You collected $10 million the same year that the LBES bonds were

authorized by the voters. This year

you may choose to collect $16 million.

There will be discussion about a 3 percent increase of something and a 2 percent increase of something else. But the essential truth is that you could skip a year altogether – a 100 percent decrease. You have amassed enough cash that taxes could be ZERO this year and you would still be able to pay all your bills for 12 months. Very few residents within the 5.6 square miles keep that kind of cash on hand in managing personal finances. Imagine: Everything your family buys in a year, from gas to groceries, including 12 months of mortgage payments, sitting in your checking account!

Prior to

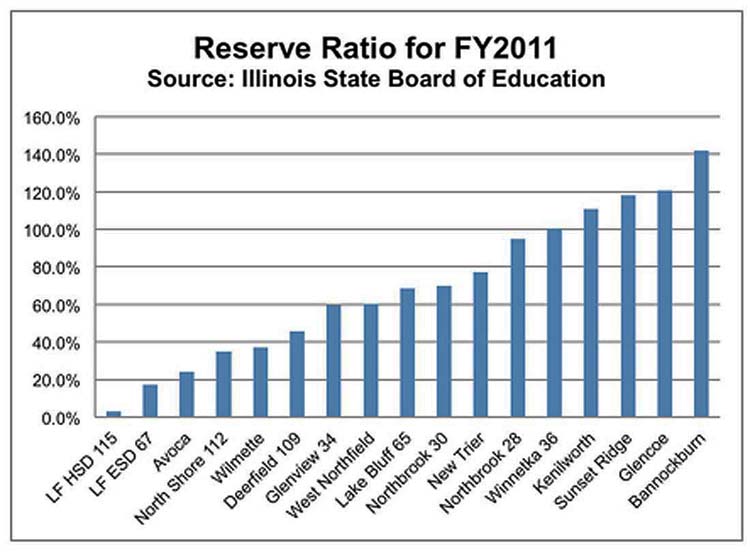

the Town Hall meeting,

Superintendent Sophie had written

about the following chart: “The

current Board of Education has expressed the desire to develop a policy on

maximum fund balance. This policy discussion will begin as part of the levy

discussion this fall and will continue as part of the district strategic

planning process this fall and winter.”

I thought

the chart was manipulative and provocative.

It was evocative of a lynch mob mentality:

“Other people are doing it so we can too.

In fact, we are right in the middle, so we must be correct.”

It is devoid of analysis or thoughtful judgment.

I was prepared to address the matter during the meeting but didn’t only

because Superintendent Sophie opened by disavowing her own chart.

She acknowledged that the presentation depends entirely on the choice of

other districts used for comparison.

Two

districts on that bar chart that are not arbitrary are 67 and 115.

And they are the two with the shortest bars.

There are

seventeen separate stories of how these seventeen districts got to where they

are. Still, new

Board Member Barry commented that 65 is in the middle and seemed to find comfort

in that. It is a false comfort.

Give me any metric for 65 and I will find eight districts with a larger

value and eight districts with a smaller value.

That proves nothing. But if

67 and 115 are together at one end of the spectrum, we must ask ourselves if we

shouldn’t try to be more like Lake Forest.

Prudent

stewardship demands the immediate transfer of $10 million to service debt, but

it also demands that the current tax levy be closely tied to the current

spending budget. The transfer and

the levy are the only concrete steps that the School Board can take to address

the burden that it has placed on its residents.

Everything else, from budgets to bar charts, is just paperwork and

promises.

On the

trading floor we sometimes joke cynically about “OPM” – other people’s money.

Board members are free to accumulate their loose change in a cookie jar

at home. Board members are free to

blow their cookie jar slush fund on any indulgence.

But when Board members are conducting public business, they must always

be mindful of OPM.

2021* student enrollment: 764

It’s not

your money. The $10 million payment

to Debt Service will return the excess taxes of the last six year to the

residents over the next six years.

Households that are resident throughout the twelve years will be made whole.

I think

there are about 2400 households in the District.

$16 million is $6,700 per household.

We will find the jobs and we will find the cash and we will pay our

bills…or we will move away. All we

ask is that the portion that you extract from us be used as carefully as we

would have used it ourselves. After

all, why build a child-friendly village if young families cannot afford to live

here?

Serving on

a public board is not about making friends.

It’s not an honorary position rewarding you for something in your past.

And it’s not about ideology.

If you really think we should spend more and tax more, we will have the nicest

empty school in Illinois.

Respectfully,

Don Russ

This

letter is also

web-readable.

*

According

to

a

February, 2012 study.

[1] name added after this letter was emailed to the School Board

[2] her name omitted at her request after this letter was emailed to the School Board

[3] this paragraph originally identified the speaker erroneously as a Park Board member, though not by name, as follows:

"Broken faith is the core issue. Accusations of hidden agendas are mere symptoms. At the facilitated focus group meeting, School Caucus member Jennifer Gleason witnessed the spectacle of a Park Board member recounting how a School Board member refused a discussion, turned his back and walked away. Presumably that is not the behavior advocated by board members in their Caucus interviews."

[4] link added after this email was sent

[5] year references changed from the December that the Board adopts a levy to the year that the May and September tax bills are received.